On August 16, President Biden signed the Inflation Reduction Act into law. You’ve probably heard something about it, especially as this legislation has been a long time coming—ever since Biden took office. Originally titled the Build Back Better[1]1 (2021) Rules Committee Print 117-18: Text of H.R. 5376, Build Back Better Act. This document can be found in HeinOnline’s U.S. Congressional Documents database. plan, which was to mainly focus on fighting climate change[2]Administration of Joseph R. Biden, Jr., 2021 Remarks on Wildfire Response Efforts and an Exchange With Reporters in Mather, California , Daily Comp. Pres. Docs. 1 (2021). This document can be found in HeinOnline’s Federal Register Library. and building a larger social safety net, Biden’s bigger plans were chipped away due to negotiations with Republicans and moderate Democrats, leaving the much smaller, though not insignificant, Inflation Reduction Act of 2022.[3]168 Cong. Rec. H7559 (2022). This document can be found in HeinOnline’s U.S. Congressional Documents database. Let’s take a look at what this bill includes, using resources from HeinOnline.

The Basics

Although the Inflation Reduction Act is much less grandiose than Build Back Better, it’s still an important accomplishment for Democrats ahead of the November midterm elections. The bill contains the largest investment in American history to combat climate change, as well as efforts to reduce healthcare and prescription medication costs,[4]Administration of Joseph R. Biden, Jr., 2021 Remarks on Prescription Drug Costs and an Exchange With Reporters , Daily Comp. Pres. Docs. 1 (2021). This document can be found in HeinOnline’s Federal Register Library. while also implementing taxes on large corporations. However, despite its name, experts doubt that the legislation will do much to reduce the skyrocketing inflation rates that have been draining the wallets of American consumers.

Major Features

Taxes

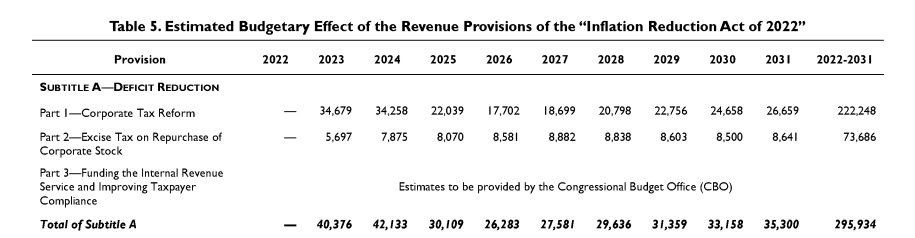

The legislation implements a 15% minimum tax on corporations[5]1 1 (August 1, 2022) Corporate Minimum Tax Proposal. This document can be found in HeinOnline’s U.S. Congressional Documents database. with at least $1 billion in income, as well as a 1% excise tax on corporation stock buybacks. Revenues from these taxes are expected to reach about $222 billion. As a note, the bill does not include any new or increased taxes on families earning $400,000 or less.

Healthcare

For the first time, Medicare will be enabled to negotiate the prices of certain prescription drugs,[6]Administration of Joseph R. Biden, Jr., 2022 Remarks on Signing Legislation To Combat Inflation, Promote Clean Energy Production, and Reduce Prescription Drug Costs , Daily Comp. Pres. Docs. 1 (2022). This document can be found in … Continue reading beginning in 2026. Initially, costs will be negotiated for 10 drugs, increasing to 20 in 2029. Pharmaceutical companies that do not comply will be subject to an up to 95% sales tax. Negotiations will only be eligible for older drugs.

In addition, beginning in 2025, Medicare recipients will be given a $2,000 cap on annual out-of-pocket prescription costs, as well as insulin costs capped at $35 a month.[7]168 Cong. Rec. S4051 (2022). This document can be found in HeinOnline’s U.S. Congressional Documents database.

Finally, the federally subsidized premiums under the Affordable Care Act which were set to expire at the end of this year will now be extended[8]Administration of Joseph R. Biden, Jr., 2022 Remarks During a Virtual Roundtable Discussion With Business and Labor Leaders on Legislation To Combat Inflation, Promote Clean Energy Production, and Reduce Prescription Drug Costs , Daily Comp. … Continue reading to 2025 to help families offset insurance costs.

However, these changes will not apply to those with private health insurance.

The IRS

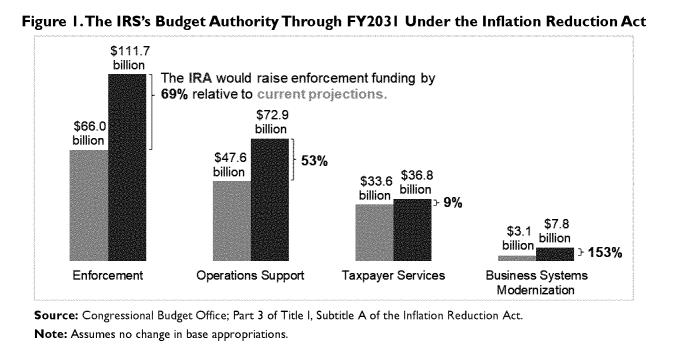

The Internal Revenue Service, which has been struggling for decades with outdated technology and overstrained staff, will be given $80 billion for upgrades[9]1 1 (August 9, 2022) IRS-Related Funding in the Inflation Reduction Act. This document can be found in HeinOnline’s U.S. Congressional Documents database. to improve enforcement and bring in revenue from wealthy tax-evaders. In addition, the bill includes a limit on losses that businesses can deduct from their taxes, helping to eliminate popular loopholes.

Climate Change

Investments in combatting climate change[10]1 1 (August 18, 2022) Inflation Reduction Act of 2022: U.S. Environmental Protection Agency and Selected Other Environmental Provisions. This document can be found in HeinOnline’s U.S. Congressional Documents database. include several incentives for both businesses and consumers. For example, incentives and tax breaks will be provided to businesses that:

- Reduce their reliance on carbon sources for energy

- Make investments into wind, solar, nuclear, hydrogen, and geothermal energy

- Create technology that helps capture carbon from fossil fuel plants

- Reduce methane emissions

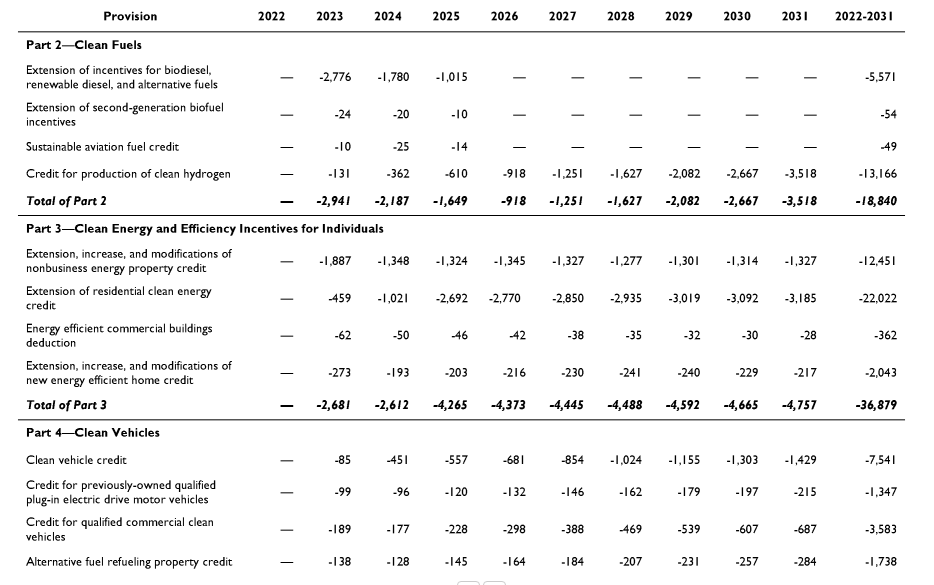

Meanwhile, consumers will benefit from tax credits for installing solar panels, heat pumps, and wind energy systems, among other clean energy sources. In addition, the bill includes tax credits up to $7,500 for purchasing electric vehicles.[11]1 15 (August 3, 2022) Tax Provisions in the Inflation Reduction Act of 2022 (H.R. 5376). This document can be found in HeinOnline’s U.S. Congressional Documents database. However, the credits only qualify for vehicles made in America and that use batteries containing materials sourced from the U.S. or its free trade partners. In addition, there are income and vehicle cost caps involved. Many electric vehicles on the market today would not qualify.

A last-minute addition to the bill includes $4 billion dollars in funding to combat the drought in the western states.[12]1 5 (August 18, 2022) Responding to Drought in the Colorado River Basin: Federal and State Efforts. This document can be found in HeinOnline’s U.S. Congressional Documents database. This money is to be used to help conserve water and cushion the impact of shrinking inland water sources, such as the Great Salt Lake.

A Congress Divided

The bill passed in the Senate[13]168 Cong. Rec. D907 (2022). This document can be found in HeinOnline’s U.S. Congressional Documents database. on August 7 with all 50 Democrat votes, after initial criticisms from senators Joe Manchin (D-W.Va.) and Kyrsten Sinema (D-AZ) were quelled after negotiations and concessions. No Senate Republicans voted for the bill, and therefore Kamala Harris provided the tie-breaking vote.

Then, the bill proceeded to pass in the House[14]168 Cong. Rec. H7559 (2022). This document can be found in HeinOnline’s U.S. Congressional Documents database. 220-207 on August 12.

According to the Congressional Budget Office, although the bill won’t do much to help inflation in the short term, it will decrease the federal deficit by over $100 billion in the next 10 years. However, the bill does leave out some of Biden’s other initiatives, particularly aimed at families, such as universal pre-K,[15]Administration of Joseph R. Biden, Jr., 2021 Remarks in Kearny, New Jersey , Daily Comp. Pres. Docs. 1 (2021). This document can be found in HeinOnline’s Federal Register Library. decreased child care costs,[16]Administration of Joseph R. Biden, Jr., 2022 The President’s News Conference , Daily Comp. Pres. Docs. 1 (2022). This document can be found in HeinOnline’s Federal Register Library. paid family leave, and increased child tax credits.

Want more timely news and updates on government, politics, law, and so much more? Check out how our bloggers are using our databases to research trending topics by subscribing to the Hein Blog! You’ll get posts delivered straight to your inbox, so you always have up-to-date information.

HeinOnline Sources[+]

| ↑1 | 1 (2021) Rules Committee Print 117-18: Text of H.R. 5376, Build Back Better Act. This document can be found in HeinOnline’s U.S. Congressional Documents database. |

|---|---|

| ↑2 | Administration of Joseph R. Biden, Jr., 2021 Remarks on Wildfire Response Efforts and an Exchange With Reporters in Mather, California , Daily Comp. Pres. Docs. 1 (2021). This document can be found in HeinOnline’s Federal Register Library. |

| ↑3 | 168 Cong. Rec. H7559 (2022). This document can be found in HeinOnline’s U.S. Congressional Documents database. |

| ↑4 | Administration of Joseph R. Biden, Jr., 2021 Remarks on Prescription Drug Costs and an Exchange With Reporters , Daily Comp. Pres. Docs. 1 (2021). This document can be found in HeinOnline’s Federal Register Library. |

| ↑5 | 1 1 (August 1, 2022) Corporate Minimum Tax Proposal. This document can be found in HeinOnline’s U.S. Congressional Documents database. |

| ↑6 | Administration of Joseph R. Biden, Jr., 2022 Remarks on Signing Legislation To Combat Inflation, Promote Clean Energy Production, and Reduce Prescription Drug Costs , Daily Comp. Pres. Docs. 1 (2022). This document can be found in HeinOnline’s Federal Register Library. |

| ↑7 | 168 Cong. Rec. S4051 (2022). This document can be found in HeinOnline’s U.S. Congressional Documents database. |

| ↑8 | Administration of Joseph R. Biden, Jr., 2022 Remarks During a Virtual Roundtable Discussion With Business and Labor Leaders on Legislation To Combat Inflation, Promote Clean Energy Production, and Reduce Prescription Drug Costs , Daily Comp. Pres. Docs. 1 (2022). This document can be found in HeinOnline’s Federal Register Library. |

| ↑9 | 1 1 (August 9, 2022) IRS-Related Funding in the Inflation Reduction Act. This document can be found in HeinOnline’s U.S. Congressional Documents database. |

| ↑10 | 1 1 (August 18, 2022) Inflation Reduction Act of 2022: U.S. Environmental Protection Agency and Selected Other Environmental Provisions. This document can be found in HeinOnline’s U.S. Congressional Documents database. |

| ↑11 | 1 15 (August 3, 2022) Tax Provisions in the Inflation Reduction Act of 2022 (H.R. 5376). This document can be found in HeinOnline’s U.S. Congressional Documents database. |

| ↑12 | 1 5 (August 18, 2022) Responding to Drought in the Colorado River Basin: Federal and State Efforts. This document can be found in HeinOnline’s U.S. Congressional Documents database. |

| ↑13 | 168 Cong. Rec. D907 (2022). This document can be found in HeinOnline’s U.S. Congressional Documents database. |

| ↑14 | 168 Cong. Rec. H7559 (2022). This document can be found in HeinOnline’s U.S. Congressional Documents database. |

| ↑15 | Administration of Joseph R. Biden, Jr., 2021 Remarks in Kearny, New Jersey , Daily Comp. Pres. Docs. 1 (2021). This document can be found in HeinOnline’s Federal Register Library. |

| ↑16 | Administration of Joseph R. Biden, Jr., 2022 The President’s News Conference , Daily Comp. Pres. Docs. 1 (2022). This document can be found in HeinOnline’s Federal Register Library. |