It’s a topic that is brought up in the news weekly, if not daily: student loan debt. President Biden made cancelling student loan debt a major part of his presidential campaign, and he recently announced a plan to cancel a significant amount of debt—but it is being fought tooth and nail in Congress and the courts. Today, student loan debt adds up to more than $1.6 trillion. So how did we get here, with so many Americans drowning in debt? Let’s use the resources in HeinOnline to find out.

The First Loans

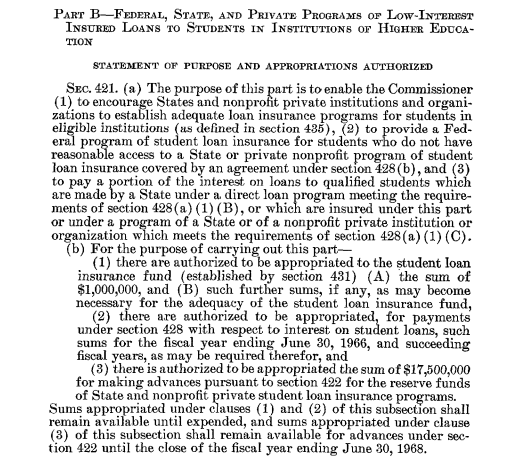

The number of Americans who attended college grew exponentially throughout the 20th century, as universities became coeducation and racially integrated. Some of the first loans to help students pay for higher education came with the G.I. Bill,[1]To provide Federal Government aid for the readjustment in civilian life of returning World War II veterans., Public Law 78-346 / Chapter 268, 78 Congress. 58 Stat. 284 (1944). This act can be found in HeinOnline’s U.S. Statutes at Large. which allowed for millions of veterans, the majority of whom were white men, to go to school for free when they returned home from World War II. In 1958, the National Defense Education Act[2]To strengthen the national defense and to encourage and assist in the expansion and improvement of educational programs to meet critical national needs; and for other purposes., Public Law 85-864, 85 Congress. 72 Stat. 1580 (1958). This act can be … Continue reading offered federal loans to students who were studying engineering, science, or education, in an attempt to bolster America’s science and technology industry in the midst of the Cold War and the Soviet Union sending Sputnik I to space. Less than a decade later, Lyndon B. Johnson signed the Higher Education Act of 1965,[3]To strengthen the educational resources of our colleges and universities and to provide financial assistance for students in postsecondary and higher education., Public Law 89-329, 89 Congress. 79 Stat. 1219 (1965). This act can be found in … Continue reading which provided grants for students based on income. Then, in 1973, the first major government loan program was formed, called the Student Loan Marketing Association, otherwise known as Sallie Mae.

Skyrocketing College Costs

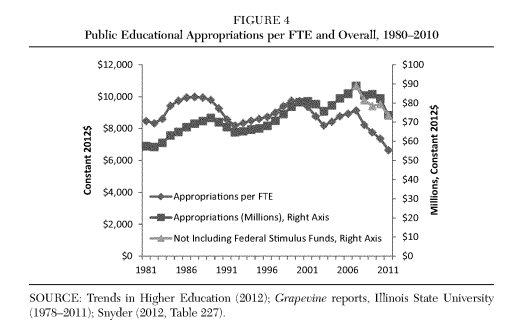

However, Reagan’s presidency brought massive cuts to higher education funding[4]98 MAJOR Legis. CONG. [28] (1984). This article can be found in HeinOnline’s Law Journal Library. and student aid—as a result, schools began to increase costs for tuition, room and board, etc. And those costs just continued to increase. The College Board estimates that from the 1980-81 school year to the 1990-91 school year, tuition for a private school increased from $17,410 to $26,050, and for a public school, from $7,900 to $9,800.

Meanwhile, college enrollment continued to grow. When the recession of 2008 hit, many Americans decided to pursue higher education to improve their skillset, increasing enrollment.[5]Andrew Barr & Sarah E. Turner, Expanding Enrollments and Contracting State Budgets: The Effect of the Great Recession on Higher Education, 650 Annals Am. Acad. Pol. & Soc. Sci. 168 (2013). This article can be found in HeinOnline’s … Continue reading But at the same time, federal and state funding for higher education decreased yet again—and it has not yet returned to pre-2008 levels. In 2019-2020, the College Board estimated that the cost to attend public universities was at $21,950 (for in-state students), and at $49,870 for private universities. Pell Grants,[6]1 2 (September 9, 2021) Federal Pell Grant Program of the Higher Education Act: Primer. This document can be found in HeinOnline’s U.S. Congressional Documents database. which once could cover nearly all of a student’s public college degree now cover about one-third of the cost[7]Administration of Joseph R. Biden, Jr., 2022 Remarks on Student Loan Debt Relief and an Exchange With Reporters , Daily Comp. Pres. Docs. 1 (2022). This document can be found in HeinOnline’s Federal Register Library.—and wages have not risen to help meet these rising costs. The average debt for a graduate is estimated to be more than $37,000. And there are about 44 million Americans who have outstanding student loan debt.

Growing Consequences

Student loan debt has vastly impacted those affected. On average, Black students owe more in student loans than white students,[8]Magdalene Mannebach, I Am Once Again Asking for Federal Student Loan Debt Reform: A Discussion on Federal Student Loan Debt and Its Negative Effects on the Race Wealth Gap, 90 UMKC L. REV. 909 (2022). This article can be found in … Continue reading and on average they make less in the workplace, which further perpetuates racial inequities and prevents Black families from accumulating generational wealth. Many who are laden with debt are choosing to put off or avoid buying houses, getting married, and starting families.[9]Amanda Claxton, Liberty and Justice for Y’All: Allowing Legal Paraprofessionals to Practice Law to Reduce the Effects of Legal Deserts in Rural Georgia, 74 MERCER L. REV. 339 (2022). This article can be found in … Continue reading And in the midst of the COVID-19 pandemic, as schools switched to online learning models, many without decreasing tuition costs, students had to decide whether or not remote schooling was worth being saddled with debt. Many of those who have student loans to pay off weren’t even able to afford to stay in school through graduation. According to the Education Data Initiative, more than 1 million student loans are defaulted every year.

The Controversial Cancellation Plan

On August 24, 2022, President Biden announced his plan to cancel some student loan debt.[10]Administration of Joseph R. Biden, Jr., 2022 Remarks on Student Loan Debt Relief and an Exchange With Reporters , Daily Comp. Pres. Docs. 1 (2022). This document can be found in HeinOnline’s Federal Register Library. The proposal, which is backed by several Democrats including Senate Majority Leader Chuck Schumer, would grant up to $10,000 in student loan cancellation for federal loan borrowers who make less than $150,000 per year in individual income, or for families who jointly earn less than $250,000. Pell Grant receivers would have up to $20,000 in loans cancelled. The Congressional Budget Office has estimated that this would cost the government about $400 billion.

In addition to cutting current debt, the plan also intends to cut monthly payments for undergraduate loans, extend the program allowing borrowers who work in public service to receive loan forgiveness, and reduce the cost of college in general.

On March 27, 2023, a group of Republican senators, led by Senator Bill Cassidy of Louisiana, released a proposal to revoke Biden’s plan.[11]169 Cong. Rec. S943 (2023). This document can be found in HeinOnline’s U.S. Congressional Documents database. If this proposal passes, Biden could veto it, and Congress would need a two-thirds majority vote to override that veto.

Additionally, in February, the Supreme Court heard a case, Biden v. Nebraska,[12]Steven D. Schwinn, Does the Secretary of Education Have Authority to Grant Partial Forgiveness for Federal Student Loans, and Do States and Individuals Have Standing to Challenge the Secretary’s Action? (22-506) (22-535), 50 PREVIEW U.S. … Continue reading that concerns the constitutionality of Biden’s plan. The case was filed by six Republican state attorneys general. The opinion will likely not be released until summer, but the majority-conservative judges appeared skeptical of the loan-forgiveness program, according to SCOTUSblog.

HeinOnline: The Database that Won’t Put You in Debt

HeinOnline is an affordable, multidisciplinary research platform that allows subscribers access to scholarly journals, case law, essential government documents, and so much more, all without breaking the bank. Be sure to subscribe to our HeinOnline Blog (which is free!) to see how our databases can be used to research all sorts of topics, from current events, to pop culture, to history, and beyond.

HeinOnline Sources[+]

| ↑1 | To provide Federal Government aid for the readjustment in civilian life of returning World War II veterans., Public Law 78-346 / Chapter 268, 78 Congress. 58 Stat. 284 (1944). This act can be found in HeinOnline’s U.S. Statutes at Large. |

|---|---|

| ↑2 | To strengthen the national defense and to encourage and assist in the expansion and improvement of educational programs to meet critical national needs; and for other purposes., Public Law 85-864, 85 Congress. 72 Stat. 1580 (1958). This act can be found in HeinOnline’s U.S. Statutes at Large. |

| ↑3 | To strengthen the educational resources of our colleges and universities and to provide financial assistance for students in postsecondary and higher education., Public Law 89-329, 89 Congress. 79 Stat. 1219 (1965). This act can be found in HeinOnline’s U.S. Statutes at Large. |

| ↑4 | 98 MAJOR Legis. CONG. [28] (1984). This article can be found in HeinOnline’s Law Journal Library. |

| ↑5 | Andrew Barr & Sarah E. Turner, Expanding Enrollments and Contracting State Budgets: The Effect of the Great Recession on Higher Education, 650 Annals Am. Acad. Pol. & Soc. Sci. 168 (2013). This article can be found in HeinOnline’s Law Journal Library. |

| ↑6 | 1 2 (September 9, 2021) Federal Pell Grant Program of the Higher Education Act: Primer. This document can be found in HeinOnline’s U.S. Congressional Documents database. |

| ↑7 | Administration of Joseph R. Biden, Jr., 2022 Remarks on Student Loan Debt Relief and an Exchange With Reporters , Daily Comp. Pres. Docs. 1 (2022). This document can be found in HeinOnline’s Federal Register Library. |

| ↑8 | Magdalene Mannebach, I Am Once Again Asking for Federal Student Loan Debt Reform: A Discussion on Federal Student Loan Debt and Its Negative Effects on the Race Wealth Gap, 90 UMKC L. REV. 909 (2022). This article can be found in HeinOnline’s Law Journal Library. |

| ↑9 | Amanda Claxton, Liberty and Justice for Y’All: Allowing Legal Paraprofessionals to Practice Law to Reduce the Effects of Legal Deserts in Rural Georgia, 74 MERCER L. REV. 339 (2022). This article can be found in HeinOnline’s Law Journal Library. |

| ↑10 | Administration of Joseph R. Biden, Jr., 2022 Remarks on Student Loan Debt Relief and an Exchange With Reporters , Daily Comp. Pres. Docs. 1 (2022). This document can be found in HeinOnline’s Federal Register Library. |

| ↑11 | 169 Cong. Rec. S943 (2023). This document can be found in HeinOnline’s U.S. Congressional Documents database. |

| ↑12 | Steven D. Schwinn, Does the Secretary of Education Have Authority to Grant Partial Forgiveness for Federal Student Loans, and Do States and Individuals Have Standing to Challenge the Secretary’s Action? (22-506) (22-535), 50 PREVIEW U.S. Sup. CT. Cas. 20 (21). This article can be found in HeinOnline’s Preview of U.S. Supreme Court Cases database. |